A home insurance quote represents an estimate of the cost of an insurance policy that covers a residential property. When you request a home insurance quote, insurance providers assess various factors to determine the coverages needed to adequately insure your home as well as risk calculations for your property. The quote is essentially the price you would pay for the insurance coverage based on these considerations.

Here are some key factors that typically influence a home insurance quote:

Property Value: The replacement cost of your home, which is the amount it would take to rebuild your home in case of a total loss, is a significant factor.

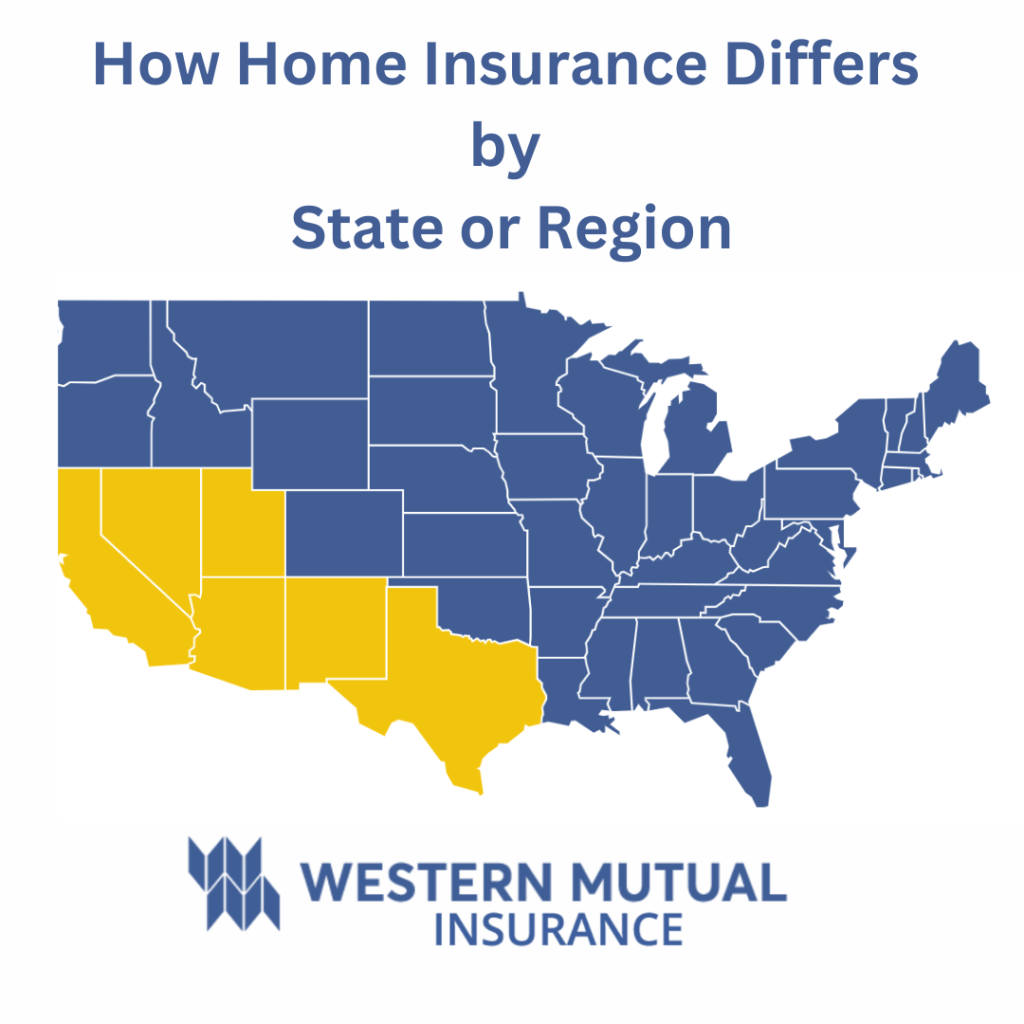

Location: The geographic location of your home plays a role in the quote. Factors such as crime rates, proximity to fire stations, and susceptibility to natural disasters can impact the cost.

Coverage Amount: The level of coverage you choose affects the quote. Higher coverage limits and additional coverage options will generally result in a higher premium.

Deductible: The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it means you’ll pay more in the event of a claim.

Home Features: Details about the construction and features of your home, such as the materials used, the age of the home, the presence of safety features (like smoke detectors and security systems), and the condition of the roof, can impact the quote.

Personal Property: The value of your personal belongings, including furniture, electronics, and other possessions, is considered in the quote. You may need to provide an estimate of the value of your personal property.

It’s essential to review the details of the quote and understand the coverage offered, as well as any exclusions or limitations. Additionally, you can often customize your coverage based on your specific needs. Keep in mind that the final premium may be subject to change based on underwriting and other considerations when you officially apply for the insurance policy.

Visit us online at WestenMutual.com