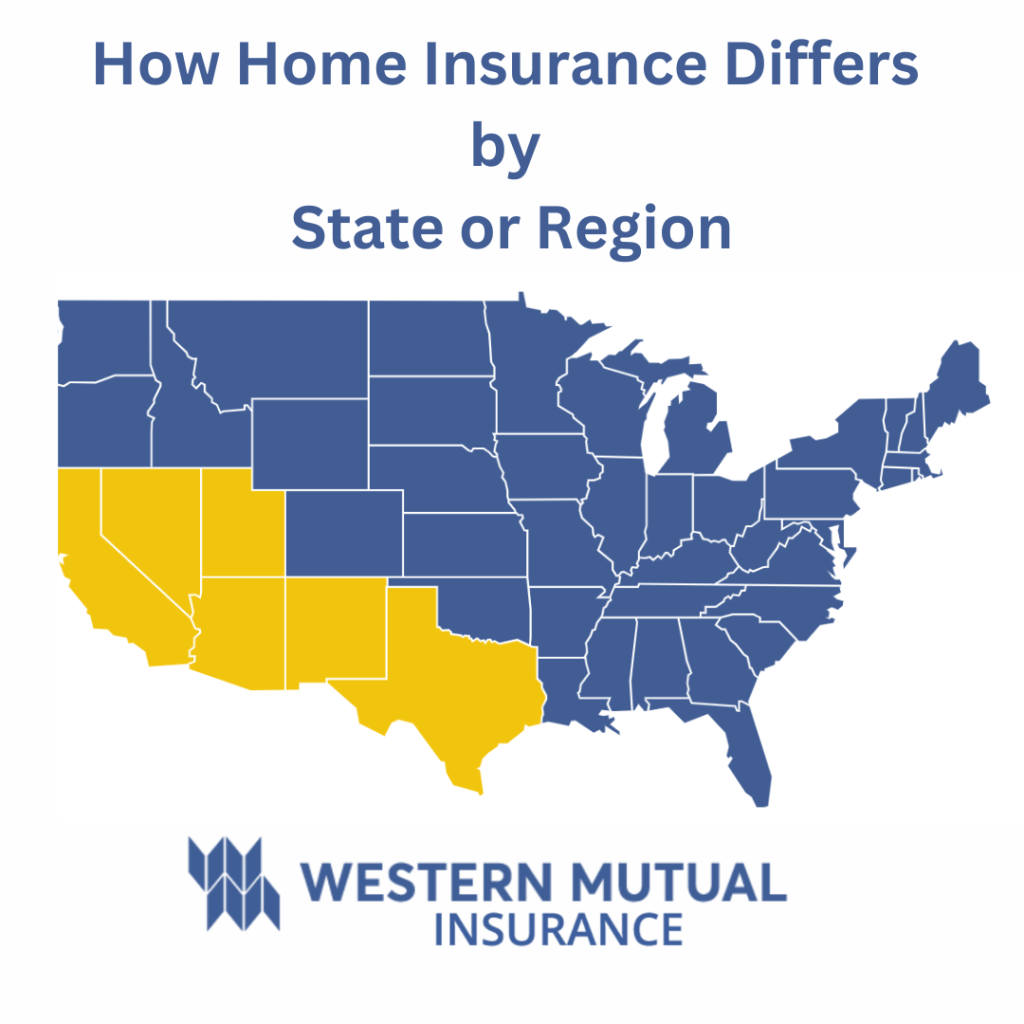

Home insurance varies significantly by state or region due to differences in geography, climate, local regulations, and risk factors. Here are the key factors that contribute to these variations:

1. Geographic Risks

Natural Disasters: States prone to specific disasters often have higher premiums or require additional coverage:

Hurricanes and Flooding: Coastal states like Florida, Texas, and Louisiana often have higher rates due to hurricane risks. Policies may require separate windstorm or flood insurance.

Earthquakes: States like California and Alaska may require earthquake insurance, which is typically not included in standard policies.

Wildfires: High-risk areas like California, Oregon, and Colorado often see higher premiums or reduced availability due to wildfire exposure.

Tornadoes: States in Tornado Alley, such as Oklahoma and Kansas, might have specific endorsements for wind and hail damage.

2. State-Specific Regulations

Coverage Requirements: Some states mandate specific types of coverage or insurance limits, affecting pricing and policy offerings.

Insurance Regulation: States like New York may have stricter consumer protection laws, impacting how policies are priced, and claims are processed.

State Insurance Pools: In high-risk areas, states may offer special programs, like Florida’s Citizens Property Insurance Corporation, for homeowners unable to find coverage on the private market.

3. Cost of Construction and Materials

Areas with higher labor costs or more expensive materials (e.g., urban areas like New York or California) may have higher premiums.

Regional building codes can influence costs; for instance, hurricane-prone areas may require more robust construction.

4. Crime Rates

High-crime areas may face increased premiums due to higher risks of theft or vandalism.

5. Market Competition

States with a larger number of insurance providers tend to have more competitive rates. Conversely, areas with fewer providers may see higher costs due to limited options.

Examples of Regional Differences:

Region Key Factors Affecting Insurance

Northeast: Snow damage, older homes, high rebuilding costs

Southeast: Hurricanes, flooding, high humidity risks (mold)

Midwest: Tornadoes, hail, flooding near rivers

West Coast: Earthquakes, wildfires, high property values

Mountain West: Wildfires, snow damage, lower population density

Southwest: Drought, heat damage, flash flooding

Understanding these differences can help homeowners select appropriate coverage and budget for insurance expenses effectively.

Visit us online at WestenMutual.com.